Sikai Wang

Plotting mechanics and EDA

Run the code below, and read along.

In the last assignment, I gave you a list of firms from 2020 with variables

- “gvkey”, “lpermno”, “lpermno” = different datasets use different identifiers for firms

- “fyear” = the fiscal year the remaining variable apply to

- “gsector” = gsector, an industry classification (see the wiki article on GICS)

- “state” = of headquarters

- “tic” = ticker

- various accounting statistics

This data is a small slice of Compustat, which is a professional grade dataset that contains accounting data from SEC filings.

We downloaded it and found a subsample of firms that we were interested in:

import pandas as pd

import numpy as np

import seaborn as sns

import pandas_datareader as pdr # to install: !pip install pandas_datareader

from datetime import datetime

import matplotlib.pyplot as plt

import yfinance as yf

plt.rcParams['patch.edgecolor'] = 'none'

# this file can be found here: https://github.com/LeDataSciFi/ledatascifi-2021/tree/main/data

# if you click on the file, then click "raw", you'll be at the url below,

# which contains the raw data. pandas can download/load it without saving it locally!

url = 'https://github.com/LeDataSciFi/data/raw/main/Firm%20Year%20Datasets%20(Compustat)/firms2020.csv'

firms_df = pd.read_csv(url).drop_duplicates('tic')

# add leverage

firms_df['leverage'] = (firms_df['dlc']+firms_df['dltt'])/firms_df['at']

# high_lev = 1 if firm is above the median lev in its industry

firms_df['ind_med_lev'] = firms_df.groupby('gsector')['leverage'].transform('median')

firms_df.eval('high_leverage = leverage > ind_med_lev',inplace=True)

# problem: if lev is missing, the boolean above is false, so

# high_lev = false... even if we don't know leverage!

# let's set those to missing (nan)

mask = (firms_df["leverage"].isnull()) | (firms_df["ind_med_lev"].isnull())

firms_df.loc[mask,"high_leverage"] = None

# reduce to subsample: (has leverage value and in our sectors)

subsample = firms_df.query('gsector in [45,20] & (high_leverage == 1 | high_leverage == 0)')

ticker_list = subsample['tic'].to_list()

Now,

- I will download their daily stock returns,

- Compute (EW) portfolio returns,

- Using (2), compute weekly total returns (cumulate the daily returns within each week).

- Note: These are not buy-and-hold-returns, but rather daily rebalancing!

- If you want buy-and-hold returns, you’d compute the weekly firm level returns, then average those compute the portfolio returns.

##################################################################

# get daily firm stock returns

##################################################################

# I called this first df "stock_prices" in the last assignment

firm_rets = (yf.download(ticker_list,

start=datetime(2020, 2, 2),

end=datetime(2020, 4, 30),

show_errors=False)

.filter(like='Adj Close') # reduce to just columns with this in the name

.droplevel(0,axis=1) # removes the level of the col vars that said "Adj Close", leaves symbols

# reshape the data tall (3 vars: firm, date, price, return)

.stack().swaplevel().sort_index().reset_index(name='Adj Close')

.rename(columns={'level_0':'Firm'})

# create ret vars and merge in firm-level info

.assign(ret = lambda x: x.groupby('Firm')['Adj Close'].pct_change())

.merge(subsample[['tic','gsector','high_leverage']],

left_on='Firm',

right_on='tic')

)

##################################################################

# get daily portfolio returns

##################################################################

# these portfolio returns are EQUALLY weighted each day (the .mean())

# this is as if you bought all the firms in equal dollars at the beginning

# of the day, which means "daily rebalancing" --> each day you rebalance

# your portfolio so that it's equally weighted at the start of the day

daily_port_ret = (firm_rets

# for each portfolio and for each day

.groupby(['high_leverage','gsector','Date'])

['ret'].mean() # avg the return for that day for the firms in the port

.reset_index() # you can work with high_leverage/sector/date as index or vars

# I decided to convert them to variables and sort

.sort_values(['high_leverage','gsector','Date'])

)

##################################################################

# get weekly portfolio returns

##################################################################

# we will cumulate the daily portfolio returns so now we have a

# dataframe that contains weekly returns for a few different portfolios

weekly_port_ret = (daily_port_ret

# compute gross returns for each asset (and get the week var)

.assign(R = 1+daily_port_ret['ret'],

week = daily_port_ret['Date'].dt.isocalendar().week.astype("int64"))

# sidenote: dt.isocalander creates a variable with type "UInt32"

# this doesn't play great with sns, so I turned it into an integer ("int64")

# for each portfolio and week...

.groupby(['high_leverage','gsector','week'])

# cumulate the returns

['R'].prod()

# subtract one

-1

).to_frame()

# this last line above (to_frame) isn't strictly necessary, but

# the plotting functions play nicer with frames than series objs

[*********************100%***********************] 388 of 388 completed

Our first plot

We can plot the weekly potfolio returns easily.

ax = weekly_port_ret.squeeze().unstack().T.plot()

# can access customization via matplotliab methods on ax

plt.show()

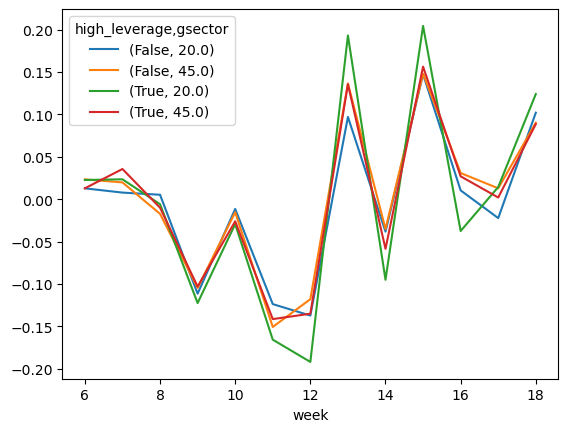

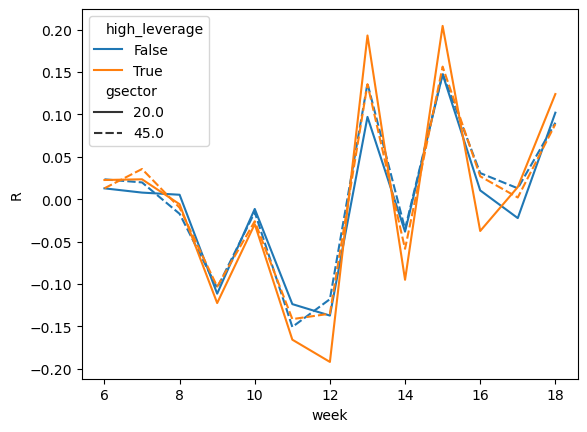

Doing this in seaborn is easy too.

ax = sns.lineplot(data = weekly_port_ret,

x='week',y='R',hue='high_leverage',style='gsector')

# can access customization via matplotlib methods on ax

plt.show()

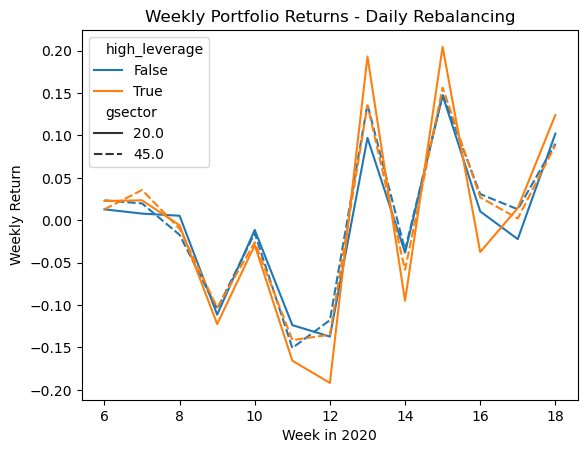

Part 1 - Plot formatting

Insert cell(s) below this one as needed to finish this Part.

Improve the plot above.

- Q1: set the title to “Weekly Portfolio Returns - Daily Rebalancing”

- Q2: set the x-axis title to “Week in 2020”

- Q3: set the y-axis title to “Weekly Return”

- Q4: Ungraded bonus challenge: change the legend so it says the industry names, not the numbers

ax = sns.lineplot(data = weekly_port_ret,

x='week',y='R',hue='high_leverage',style='gsector')

# Q1

plt.title("Weekly Portfolio Returns - Daily Rebalancing")

# Q2

plt.xlabel("Week in 2020")

# Q3

plt.ylabel("Weekly Return")

# Q4

plt.show()

Part 2 - Replicate/Imitate

Insert cell(s) below each bullet point and create as close a match as you can. This includes titles, axis numbering, everything you see.

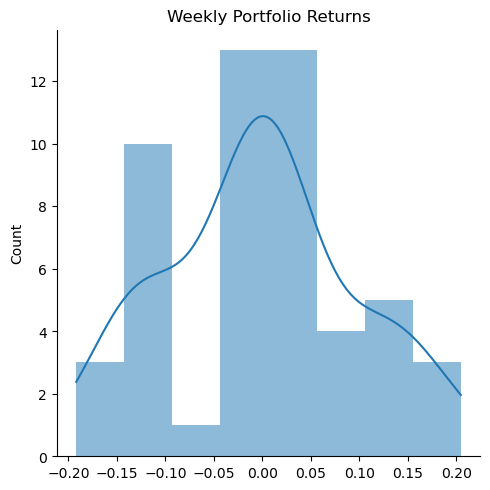

- Q5: Replicate F1.png. Notice the x-axis has no label - it’s in the title.

Q5_plot=sns.displot(data=weekly_port_ret,x='R',kde=True)

Q5_plot.set(xlabel=None)

plt.title('Weekly Portfolio Returns')

plt.show()

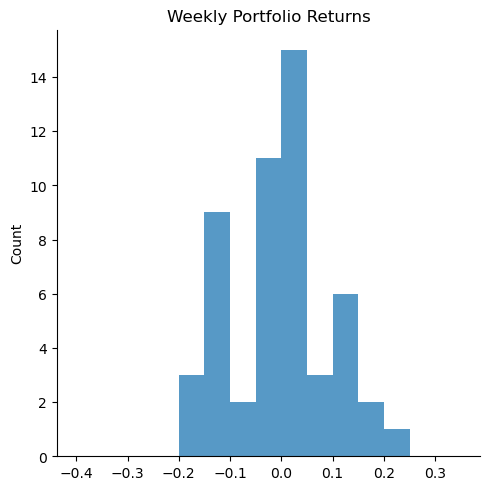

- Q6: Replicate F2.png. Notice the bin sizes are 5%.

Q6_plot=sns.displot(data=weekly_port_ret,x='R',bins=np.arange(-0.4, 0.4, 0.05))

Q6_plot.set(xlabel=None)

plt.title('Weekly Portfolio Returns')

plt.show()

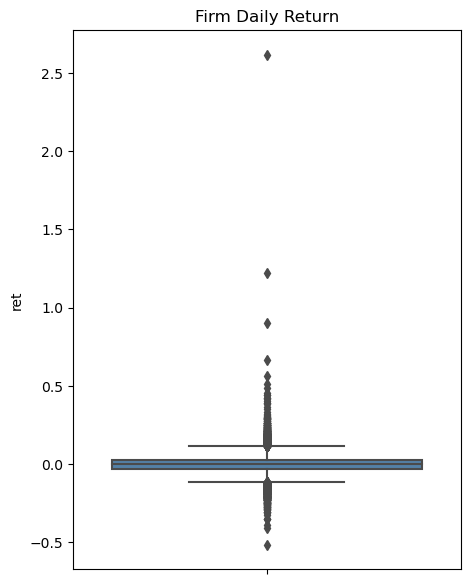

- Q7: Replicate F3.png. Pay attention to the header for a clue!

plt.figure(figsize=(5, 7))

sns.boxplot(y='ret', data=firm_rets, color='steelblue')

plt.title('Firm Daily Return')

plt.show()

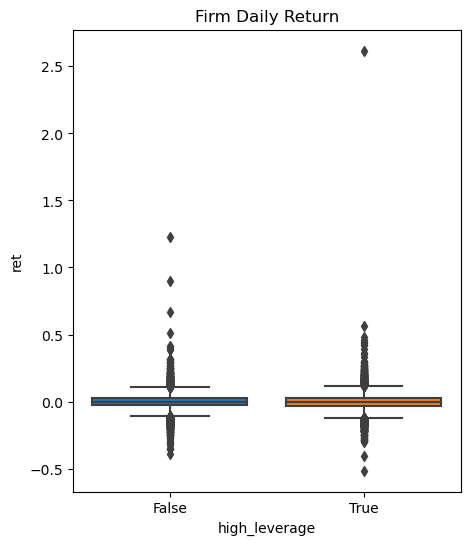

- Q8: Replicate F4.png. Pay attention to the header for a clue!

plt.figure(figsize=(5, 6))

sns.boxplot(x='high_leverage', y='ret', data=firm_rets)

plt.title('Firm Daily Return')

plt.show()

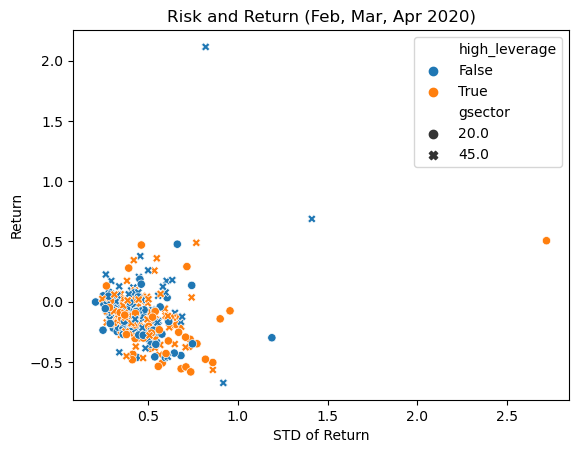

- Q9: Replicate this figure, using this

totaldataset:

total = pd.DataFrame() # open an empty dataframe

total['ret'] = (firm_rets.assign(ret=firm_rets['ret']+1) # now we have R(t) for each observation

.groupby('tic')['ret'] # for each firm,

.prod() # multiple all the gross returns

-1 # and subtract one to get back to the total period return

)

total['cnt'] = firm_rets.groupby('tic')['ret'].count()

total['std'] = firm_rets.groupby('tic')['ret'].std()*np.sqrt(total['cnt'])

total = total.merge(firm_rets.groupby('tic')[['high_leverage','gsector']].first(),

left_index=True, right_index=True)

total = pd.DataFrame() # open an empty dataframe

total['ret'] = (firm_rets.assign(ret=firm_rets['ret']+1) # now we have R(t) for each observation

.groupby('tic')['ret'] # for each firm,

.prod() # multiple all the gross returns

-1 # and subtract one to get back to the total period return

)

total['cnt'] = firm_rets.groupby('tic')['ret'].count()

total['std'] = firm_rets.groupby('tic')['ret'].std()*np.sqrt(total['cnt'])

total = total.merge(firm_rets.groupby('tic')[['high_leverage','gsector']].first(),

left_index=True, right_index=True)

total

| ret | cnt | std | high_leverage | gsector | |

|---|---|---|---|---|---|

| tic | |||||

| AAPL | -0.065597 | 60 | 0.348535 | True | 45.0 |

| ABM | -0.064676 | 60 | 0.426696 | False | 20.0 |

| ACLS | 0.048741 | 60 | 0.557596 | False | 45.0 |

| ACM | -0.225210 | 60 | 0.438323 | False | 20.0 |

| ACN | -0.093329 | 60 | 0.347341 | False | 45.0 |

| ... | ... | ... | ... | ... | ... |

| XRX | -0.468449 | 60 | 0.473751 | True | 45.0 |

| XYL | -0.111853 | 60 | 0.371912 | True | 20.0 |

| YELL | -0.254464 | 60 | 0.671546 | True | 20.0 |

| ZBRA | 0.009977 | 60 | 0.388039 | True | 45.0 |

| ZS | 0.172650 | 60 | 0.383923 | True | 45.0 |

342 rows × 5 columns

sns.scatterplot( x="std", y="ret", data=total, hue='high_leverage',style = 'gsector')

plt.legend(loc='upper right')

plt.title("Risk and Return (Feb, Mar, Apr 2020)")

plt.xlabel("STD of Return")

plt.ylabel("Return")

plt.show()

Q10: Choose your adventure. Some ideas:

- Use a pairplot, jointplot, or heatmap on any data already loaded on this page (including the original

firms_df). - Convert any of the stock price datasets to a “wide” format and then use the pair_hex_bin code from the communiy codebook.

- Do something fun with the parameters of the function you choose.

- Or adapt this to improve our portfolio returns plot from Part 1, because Part 1 created a tough to interpret “spaghetti” plot!

- Plot the cumulative returns over the sample period for the four portfolios’ weekly returns from Part 1

- Adapt this to improve our weekly portfolio returns plot from Part 1.

Then save the figure as a png file and share it here on the discussion board.

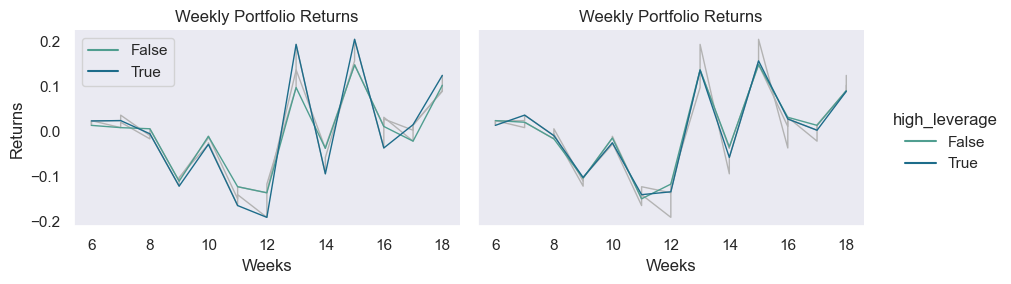

sns.set_theme(style="dark")

# Plot each year's time series in its own facet

g = sns.relplot(

data=weekly_port_ret,

x="week", y="R", col="gsector", hue="high_leverage",

kind="line", palette="crest", linewidth=1, zorder=6,

col_wrap=2, height=3, aspect=1.5, legend=True,

)

# Iterate over each subplot to customize further

for year, ax in g.axes_dict.items():

# Plot every year's time series in the background

sns.lineplot(

data=weekly_port_ret, x="week", y="R", units="high_leverage",

estimator=None, color=".7", linewidth=1, ax=ax,

)

# Tweak the supporting aspects of the plot

g.set_titles("Weekly Portfolio Returns")

g.set_axis_labels("Weeks", "Returns")

g.tight_layout()